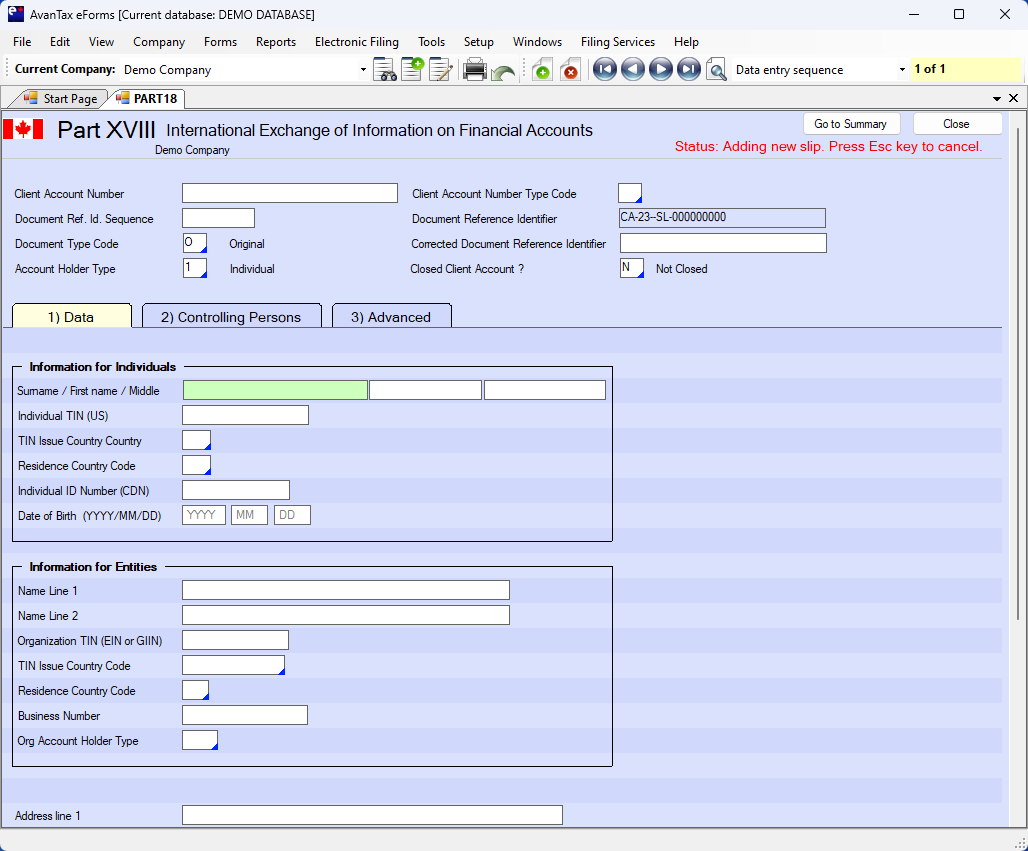

Part XVIII (FATCA) - International Exchange of Information on Financial Accounts

(en anglais seulement)

Part XVIII is available as an add-on module for AvanTax eForms Enterprise.

Under Part XVIII of the Income Tax Act, Canadian financial institutions are required to:

- apply due diligence procedures to identify U.S. reportable accounts and accounts held by non–participating financial institutions; and

- annually report to the Canada Revenue Agency (CRA) the information required on a Part XVIII Information Return