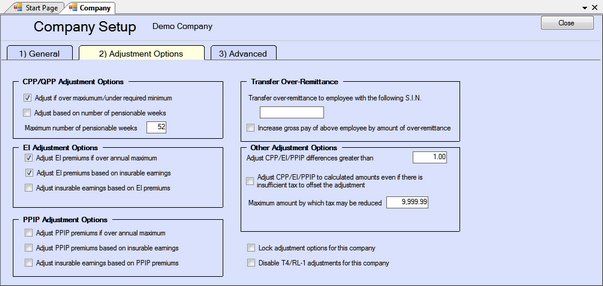

MENU: COMPANY > COMPANY SETUP > Tab 2

eForms allows you to customize adjustment of CPP/QPP, EI and PPIP/QPIP discrepancies for individual companies. When you add a new company, eForms inserts the default values from the T4 Adjustment Defaults page in the Setup menu. See Contribution Rates and Constants for the 2025 deduction rates. Adjustment options for the current company can be modified as necessary.

AvanTax eForms Standard & Enterprise Only

eForms Standard and Enterprise versions use an enhanced Adjustment Options screen which adds the following adjustment options:

Lock adjustment options for the current company

When selected, this option locks the adjustment options for the current company. Adjustment options that have been locked for any company will not be modified when using the Global Changes > Adjustment Options tool from the Tools menu to change adjustment options for any companies in the database.

Disable T4/Relevé 1 adjustments for the current company

Disables T4 and Relevé 1 adjustments for the current company. CPP/QPP, EI and PPIP/QPIP values will not be adjusted for any company with this option selected when the Adjustment Report is run.

Refer to the following topics for detailed information on how each adjustment option affects entered data: