AvanTax eForms from Start to Finish

QuickHelps Video - AvanTax eForms from Start to Finish

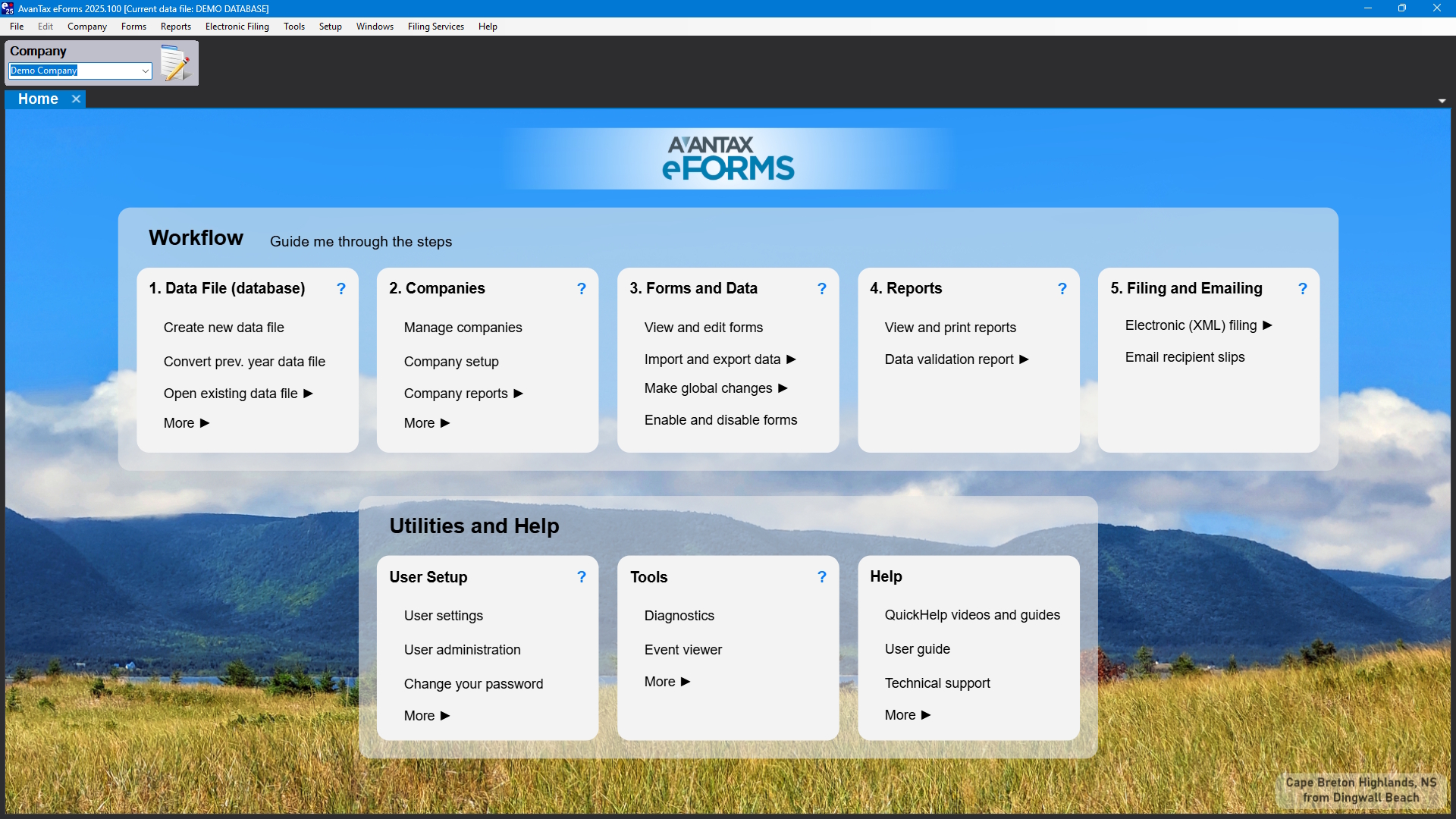

The AvanTax eForms Home Screen

The major steps in preparing a typical tax return with AvanTax eForms are listed below. Links to resources within this user guide and on the eForms, CRA and Revenu Québec websites are provided; you can also use the search box at the top of each page of this guide to search the entire guide for more information.

-

Purchase eForms from the AvanTax Online Store

-

Download the eForms installation file from the AvanTax eForms download page

-

Follow the installation instructions to install eForms

-

You must have an open data file before you can begin to enter data, you can open a data file by one of the following:

-

Once you’ve created or opened a data file, you must create or open a company before you can begin to enter slip information. Company summaries are calculated as slip data is entered or imported.

-

Before entering or importing data, configure the data file to contain the needed forms; the forms below are configured by default, and cannot be disabled

- CRA - T4, T4A, & T5

- Revenu Québec - Relevé 1 & Relevé 3

-

Enter data into the data file by one of the following:

- manually enter data using eForms’ data entry screens

- roll data forward (convert) from eForms 2024

- import data from an Excel or XML file with eForms Standard or eForms Enterprise

-

Print an Edit List to check data for errors and correct as necessary.

-

Run the Adjustment Report, if desired, to calculate CPP/QPP; PPIP & EI deductions for T4 and Relevé 1 slips.

-

Prepare the XML submission; XML filing is required by both CRA and Revenu Québec for returns containing 5 or more slips. NOTE: Revenu Québec XML submissions MUST be completed BEFORE preparing & distributing recipient slips

-

Submit the return(s) to the CRA or Revenu Québec filing portal, and record any submission confirmation information. NOTE: Returns containing more than 5 slips MUST be submitted electronically.

-

Prepare slips and summaries for distribution and/or records keeping.

-

Add, Amend or Cancel slips or returns as updated information becomes available

-

Archive your data for re-issuing lost slips or (gasp!) subsequent audits