Adjusting CPP/QPP, EI & PPIP/QPIP

QuickHelps Video - How to Adjust CPP/QPP, EI/AC & PPIP/QPIP Data

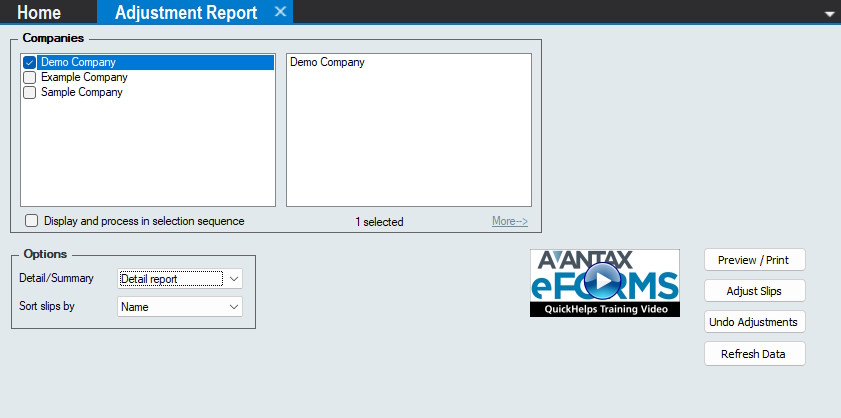

Adjustment Report

From the Menu use: Company > Adjust / Unadjust Slips

The Adjustment Report dialog adjusts CPP/QPP, EI and PPIP/QPIP deductions and insurable earnings reported on T4 and Relevé 1 slips. NOTE: The Adjustment Report WILL NOT perform any adjustment calculations on Relevé 1 slips which have been de-linked from T4 slips.

Refer to Company Adjustment Options to see how the adjustments will be calculated for the current company.

Refer to User Settings > Adjustment Options to see the default adjustment options applied to a new company.

Adjustment Report

Use the Company Selection dialog to select the companies for which to prepare reports.

Options

Detail / Summary - Select whether you require a detailed or summary report

Sort slips by - Select whether slips will be displayed in Name, S.I.N. or Employee Number order

Buttons

Preview / Print - Performs the desired adjustment calculations, according to the adjustment options in place for each company, and creates the adjustment report

Adjust Slips - Performs the desired adjustment calculations, according to the adjustment options in place for each company, without producing the adjustment report; the adjusted values will appear in the “Adjusted” column on the T4 and Relevé 1 slips when you view them and will be the values printed on the slips when they are printed

Undo Adjustments - Reverses previous adjustments, removing the adjusted data from the T4 and Relevé 1 slips and reverting them back to the originally entered values

Refresh Data - Updates any company data that may have changed since the Adjustment Report dialog was opened

Applying Adjustments

There are two methods of adjusting T4 and Relevé 1 slips. All adjustments are made based on the Company Adjustment Options settings for the current company.

- Adjust all slips for the company by using the Adjust/Unadjust Slips from the Company menu; individual slips that should not be adjusted can be excluded by checking the appropriate Do not adjust boxes on that slip’s data entry screen.

NOTE: Adjustments made using this method WILL BE included in the corresponding T4 or Relevé 1 summary, and on any XML submissions to CRA or Revenu Québec. - Adjust only the currently displayed T4 or Relevé 1 by clicking the Adjust button on the slip’s data entry form.

NOTE: Because only an individual slip is being adjusted, adjustments made using this method WILL NOT be included in the corresponding T4 or Relevé 1 summary, or on any XML submission to CRA or Revenu Québec

The adjustment report can be produced by selecting Adjust/Unadjust T4 Slips from the Company menu and clicking Adjust Slips + Report, or you can select Adjustments from the T4 submenu of the Reports menu. In either case an Adjustment Report window will open. See IF CHM,HTML,PDFPrinting Adjustment ReportsELSEPrinting Adjustment ReportsEND for further details.

Reversing Adjustments

There are two methods of reversing the adjustments that have been made to T4 and Relevé 1 slips. Once complete, all adjusted values will have been returned to their original values.

- The adjustments on all of the slips for the company can be reversed by selecting Adjust/Unadjust Slips from the Company menu and clicking the Undo adjustments button, adjusted CPP, QPP, EI and tax values will be reversed and the original values will be restored

- Reverse the adjustment on an individual adjusted T4 or Relevé 1 by clicking the Unadjust button on the slip’s data entry form, adjusted CPP, QPP, EI and tax values will be reversed and the original values will be restored; the Unadjust button will not be displayed if a slip has not been adjusted