Entering & Editing Summary Data

QuickHelps Video - Edit Slip & Summary Forms

From the Home Screen use: 3. Forms and Data > View and edit forms

From the Menu use: Forms > Forms Centre

Refer to The Forms Centre for details on selecting the return type and form to edit.

Summary Data Entry Screen

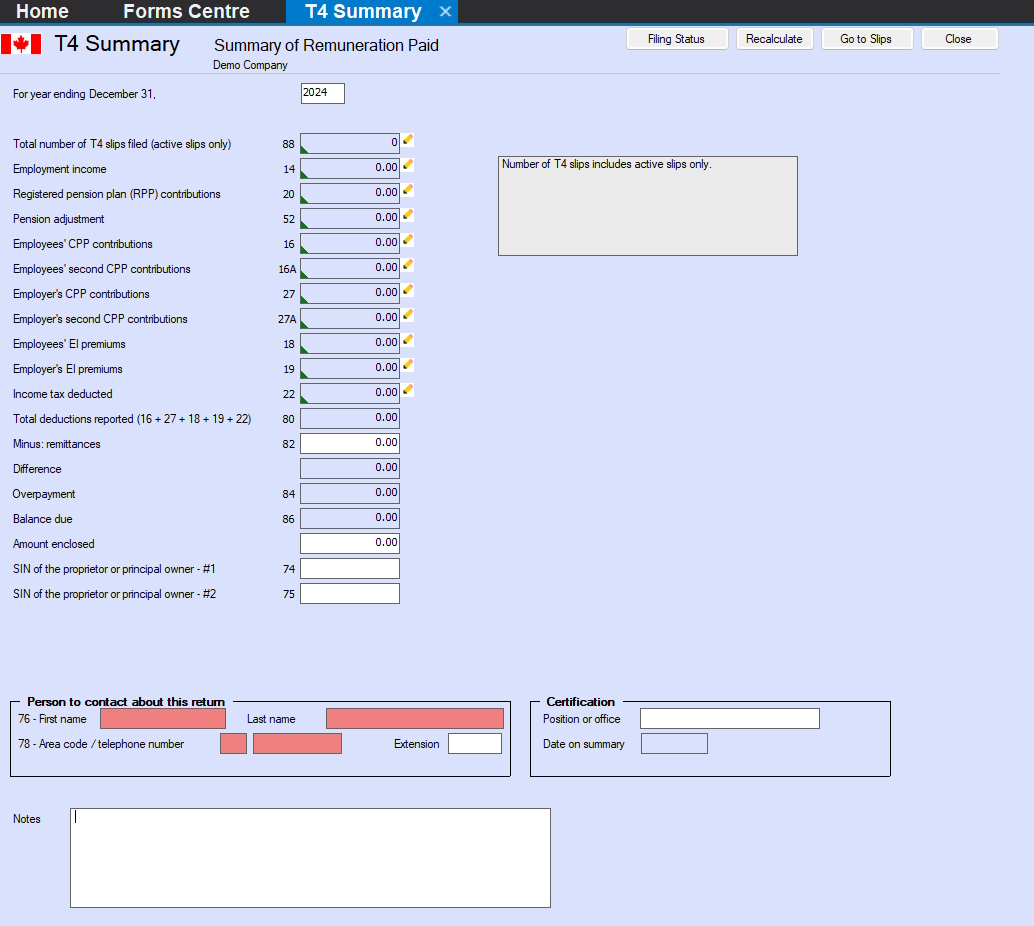

An example of the T4 summary data entry screen is displayed below.

T4 Summary Data Entry Screen

Buttons

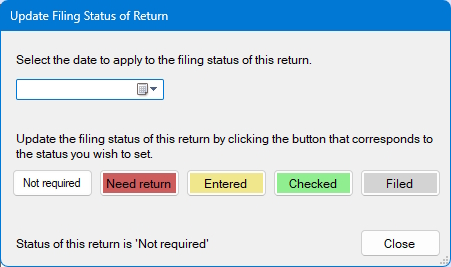

Filing Status - Displays a window where the filing status of the current return for the current company can be selected. Changes made to the filing status apply only to the current return for the current company.

Available filing status options are:

- Not Required - A return of this type is not required for the current company

- Need Return - A return of this type is required for the current company

- Entered - Data has been entered for this return

- Checked - Data entered for this return has been checked

- Filed - This return has been filed with the CRA and/or Revenu Québec

Recalculate - Recalculates all calculated values and restores all overridden fields to their calculated value.

Go to Slips - Display the data entry screen for the slips related to the summary; the summary data entry screen will remain available via a tab beneath the toolbar.

Close Button - Closes the summary, all data is saved to the data file before closing.

Fields

The majority of the fields on the summary data entry screen are totals of corresponding fields of the associated slips and will be filled with a solid colour. Calculated values which can be overridden are indicated by

![]()

![]()

To revert an individual field to its calculated value, press F4 or double click in the field. To revert all fields to their calculated values, click on the Recalculate button. In either case you will be asked to confirm the return to the calculated value.

To enter data into a data entry screen, simply select a field and type the data into it, then hit either TAB or ENTER to move the cursor to the next field.

Minus remittances - Enter the amount of money already remitted to CRA or Revenu Québec

Amount Enclosed - Enter the amount that will be enclosed with the submission

SIN of the prorietor or principal owner - Some summaries may include fields in which the SIN of the proprietor or principal owner may be identified

Person to contact about this return - Enter the contact information of the person whom CRA or Revenu Québec could contact if they have quesitons about this return; fields indicated in red _MUST be completed.

- The default contact information entered on the New Company Defaults page of the User Settings screen will appear in this area for any new company. If no default information was entered, these fields will be blank.

Certification - Enter the name of the person who has authorization to certify this return as being correct; fields indicated in red _MUST be completed.

- The default certification information entered on the New Company Defaults page of the User Settings screen will appear in this area for any new company. If no default information was entered, these fields will be blank.

- Date on summary - Data in this field is for display purposes only; in order to print a specified date on the summary you must use the “Print this date” option in the “Options” section in the lower left corner of the Printing Summary ReportsEND screen.