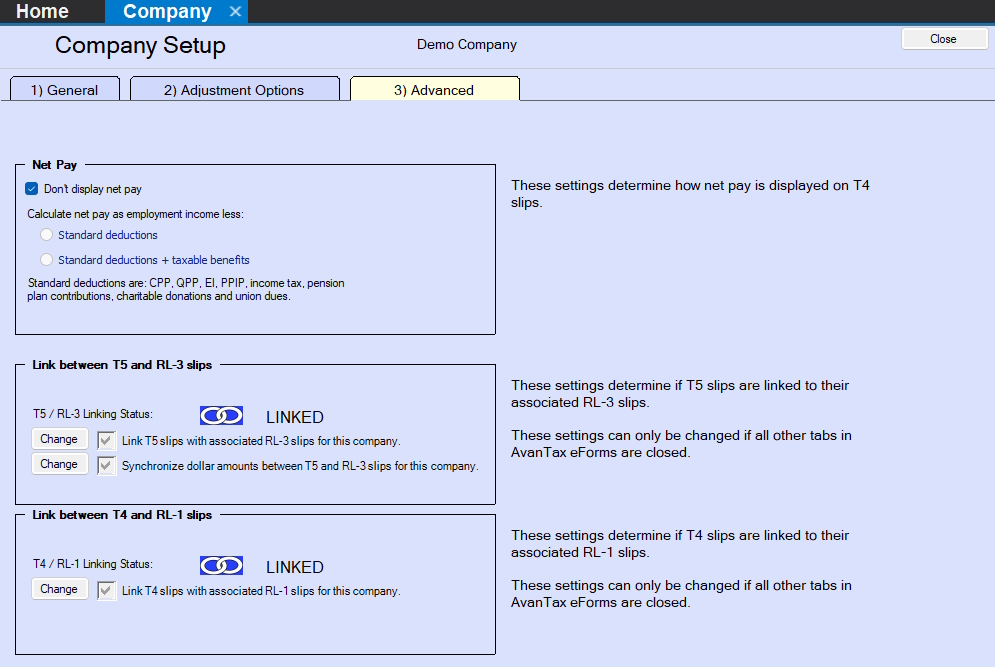

Advanced Company Setup Options

Net Pay - The settings in this section determine how net pay is displayed on T4 slips.

- Uncheck the “Don’t display net pay” option to display net pay; the default option is for Net Pay to not be displayed. Net pay is calculated as one of the following:

- Employment Income - Standard Deductions

- Employment Income - Standard Deductions - Taxable Benefits

Standard deductions include: CPP/QPP, EI, PPIP/QPIP; federal and provincial income tax; pension plan contributions; charitable donations and union dues. Taxable benefits are calculated as the total of all boxes containing taxable benefits. Other deductions (if any) are entered manually on the Net Pay form (when Net Pay is being displayed).

Link between T5 and Relevé 3 slips

The settings in this section determine how eForms will handle T5 & Relevé 3 slip pairs.

Link T5 slips with associated Relevé 3 slips for this company - Allows you to link or unlink T5 slips to their associated Relevé 3 slips. By default, they will be linked to each other.

Synchronize dollar amounts between T5 and Relevé 3 slips for this company - If checked (the default), the numeric data is synchronized between T5 & Relevé 3 pairs; if a dollar value is changed on a T5 slip, its corresponding value on the associated Relevé 3 slip will also be changed. If this box is unchecked, synchronization of numeric data will no longer take place; numeric data changed on a T5 slip will not cause changes on the associated Relevé 3 slip. Non-numeric data will always be synchronized. NOTE: All T5 and Relevé 3 windows must be closed before applying this option.

Link between T4 and Relevé 1 slips

The settings in this section determine how eForms will handle T4 & Relevé 1 slip pairs.

Link T4 slips with associated Relevé 1 slips for this company - Allows you to link or unlink T4 slips to their associated Relevé 1 slips. By default, they will be linked to each other. NOTE: The Adjustment Report will not perform any adjustment calculations on associated T4 or Relevé 1 slips if they have been de-linked from each other.