Company Adjustment Options

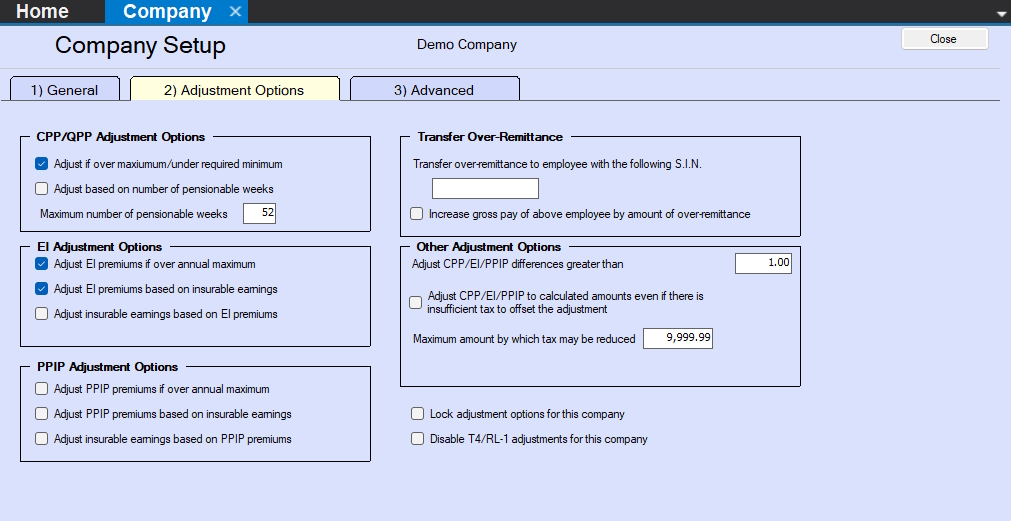

eForms allows you to customize adjustment of CPP/QPP, EI and PPIP/QPIP discrepancies for individual companies. When you add a new company, eForms inserts the default values from the T4 Adjustment Defaults page in the Setup menu. See Contribution Rates and Constants for the 2025 deduction rates. Adjustment options for the current company can be modified as necessary.

The adjustment options for each company are stored with the company profile. To change the adjustment options for the current company select Company Setup from the Company menu and then click the Adjustment Options page. You can make changes to any of the options and also enter the SIN of the individual designated to receive the transfer of over remittance of CPP and EI.

Use the T4 Adjustment Defaults page in the Setup menu if you want to change the default adjustment options for all new companies. The global default adjustment options are applied to each new company added to the eForms database. To change the adjustment options for selected existing companies use the Adjustment Options option of the Global Changes sub-menu of the Tools menu.

All adjustments made to CPP/QPP, EI and PPIP/QPIP will be added to or removed from the recipient’s tax.

CPP/QPP Options

| CRA | Rate | Revenu Québec | Rate |

|---|---|---|---|

| CPP Contribution Rate | 5.95% | QPP Contribution Rate | 6.400% |

| CPP2 Contribution Rate | 4.000% | QPP2 Contribution Rate | 4.000% |

| CPP Max. Employee Contribution | $4,034.10 | QPP Max. Employee Contribution | $4,339.20 |

| CPP2 Max. Employee Contribution | $396.00 | CPP2 Max. Employee Contribution | $396.00 |

| CPP Basic Exemption | $3,500.00 | QPP Basic Exemption | $3,500.00 |

| CPP Max. Pensionable Earnings | $71,300.00 | QPP Max. Pensionable Earnings | $71,300.00 |

| CPP2 Max. Pensionable Earnings | $81,200.00 | QPP2 Max. Pensionable Earnings | $81,200.00 |

CPP2/QPP2 will always be calculated as follows, regardless of which adjustment option is chosen:

(the lesser of Pensionable Earnings AND $81,200.00 – $71,300.00) x 4.000%

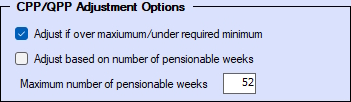

Adjust if Over Maximum / Under Minimum

This option ignores any potential reduction resulting from the annual CPP/QPP basic exemption of $3,500.00 and is used in situations where it is not possible to enter the number of pensionable weeks on each T4 or Relevé 1.

If this option is selected, CPP will be calculated within the range where the maximum CPP will be calculated as:

(CPP Pensionable Earnings X 5.95%) OR $4,034.10 - whichever is least

and the minimum CPP will be calculated as:

((CPP Pensionable Earnings - $3,500.00) X 5.95%) OR $4,034.10 - whichever is least

If this option is selected, QPP will be calculated within the range where the maximum QPP will be calculated as:

(QPP Pensionable Earnings X 6.400%) OR $4,339.20 - whichever is least

and the minimum QPP will be calculated as:

((QPP Pensionable Earnings - $3,500.00) X 6.400%) OR $4,339.20 - whichever is least

CPP/QPP deducted will be reduced to the upper limit or increased to the lower limit as necessary; CPP/QPP deducted will not be adjusted if it lies between the limits stated above.

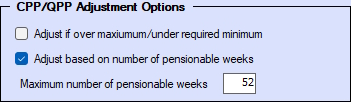

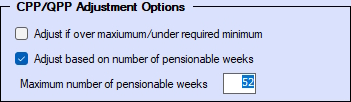

Adjust Based on Pensionable Weeks

This option prorates the annual CPP/QPP basic exemption of $3,500.00 and is used in situations where the number of pensionable weeks has been entered on each T4 or Relevé 1.

If this option is selected CPP/QPP adjustments will be calculated as:

CPP - (CPP Pensionable Earnings - Prorated Deduction) X 5.95%

QPP - (QPP Pensionable Earnings - Prorated Deduction) X 6.400%

with the Prorated Deduction calculated as:

(number of pensionable weeks / maximum number of pensionable weeks) x $3,500.00

Maximum Number of Pensionable Weeks

This number is the number of weeks in the employer’s fiscal year and is used in the above calculation to prorate the CPP/QPP basic exemption. The default is 52 weeks.

EI Options

| CRA | Rate | Revenu Québec | Rate |

|---|---|---|---|

| Contribution Rate | 1.64% | Contribution Rate | 1.31% |

| Max. Employee Contribution | $1,077.48 | Max. Employee Contribution | $860.67 |

| Max. Insurable Earnings | $65,700.00 | Max. Insurable Earnings | $65,700.00 |

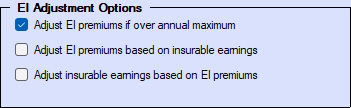

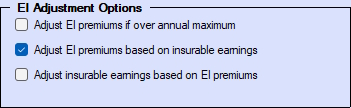

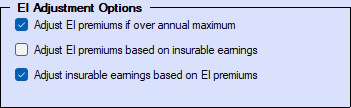

Adjust EI Premiums if Over Annual Maximum

If this option is selected, the EI will only be adjusted if it is greater than:

CRA - (EI Insurable Earnings X 1.64%) OR $1,077.48 - whichever is least

Revenu Québec - (EI Insurable Earnings X 1.31%) OR $860.67

- whichever is least

Adjust EI Premiums Based on Insurable Earnings

If this option is selected, the EI will be calculated as:

CRA -EI Insurable Earnings X 1.64%

Revenu Québec -EI Insurable Earnings X 1.31%

Adjust Insurable Earnings Based on EI Premiums

This option assumes the entered amount for EI deducted is correct. When this option is selected, EI insurable earnings will be calculated as:

CRA - (EI Deducted / 1.64%) OR $65,700.00 OR (Employment income) - whichever is least

Revenu Québec - (EI Deducted / 1.31%) OR $65,700.00 OR (Employment income) - whichever is least

PPIP/QPIP Options

| CRA & Revenu Québec | Rate |

|---|---|

| Max Insurable Earnings | $98,000.00 |

| Max. Employee Premium | $484.12 |

| Employee Premium Rate | 0.494% |

| Employer Premium Rate | 0.692% |

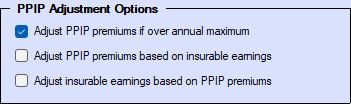

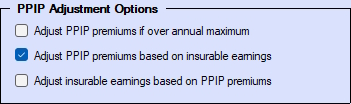

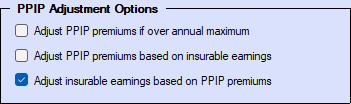

Adjust PPIP premiums if over annual maximum

If this option is selected, PPIP will only be adjusted if it is greater than:

$98,000.00 X 0.494% = $484.12

Adjust PPIP premiums based on Insurable Earnings

If this option is selected, the PPIP premiums will be calculated as:

_PPIP Insurable Earnings X 0.494%

(Gross Pay is used if insurable earnings have not been entered)_

Adjust insurable earnings based on PPIP deducted

This option assumes the entered amount for PPIP deducted is correct. When this option is selected, PPIP insurable earnings will be calculated as:

(PPIP deducted / 0.494%) OR $98,000.00 OR Employment Income - whichever is least

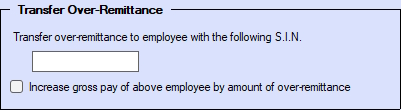

Transfer Over-Remittance

When adjustments reduce total deductions for the company, the employer’s portion of the over-remittance may be transferred to the tax of an owner or shareholder by entering a SIN is entered in this field. Any net overpayment of CPP/QPP, EI and PPIP/QPIP resulting from adjustments calculated by the program will be credited to the tax deducted on the T4 of the recipient with this SIN. This adjustment will be reflected in the adjusted tax on the adjustment reports for the particular recipient.

Increase gross pay of above employee by amount of over-remittance - If an over remittance is created by the adjustments and the over remittance is being transferred to a specific recipient, you may also increase the gross pay for the recipient in order to keep the net pay at the same level. If this option is chosen and the transferee’s CPP/QPP is under the maximum deduction for the year, the CPP/QPP will NOT be adjusted again for this underpayment.

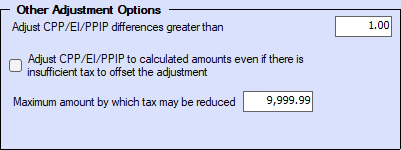

Other Adjustment Options

Adjust CPP/EI/PPIP differences greater than - Adjustments to CPP/QPP, EI or PPIP/QPIP will be made only if they exceed the value entered here. No adjustments will be made if the difference between the calculated amount and the entered amount for CPP/QPP, EI or PPIP/QPIP is less than or equal to this value and the unadjusted values will be reported. The default is $1.00.

Adjust CPP/EI/PPIP to calculated amounts even if there is insufficient tax to offset the adjustment - Any adjustments increasing the amount entered for CPP/QPP, EI or PPIP/QPIP will be taken from income tax deducted. When this option is selected, entered values will be adjusted to the calculated amounts even if insufficient tax exists to make up the difference. If there is insufficient tax to cover the adjustment to CPP/QPP, EI and PPIP/QPIP, the difference will be posted to the T4 Summary. The shortfall is made up of the increase in the employer’s contribution and the increase in the employee’s contribution which was not offset by tax. The employer must make up the difference when filing the Summary and collect the under-contributed employee’s portion from the employee.

Maximum amount by which tax may be reduced - Enter the maximum amount by which tax may be reduced. For example: Enter $100.00 to limit tax decreases to no more than $100.00. The default is $9,999.99.

Standard & Enterprise Only

Both eForms Standard and eForms Enterprise use an enhanced Adjustment Options screen which adds the following adjustment options to the lower right of the Adjustment Options tab:

Lock adjustment options for the current company

When selected, this option locks the adjustment options for the current company. Adjustment options that have been locked for any company will not be modified when using the Global Changes > Adjustment Options tool from the Tools menu to change adjustment options for any companies in the database.

Disable T4/Relevé 1 adjustments for the current company

Disables T4 and Relevé 1 adjustments for the current company. CPP/QPP, EI and PPIP/QPIP values will not be adjusted for any company with this option selected when the Adjustment Report is run.